Across the globe, the usage of fintech applications is growing at a phenomenal pace. Much of this growth can be largely attributed to the rapid proliferation of mobile phones and mobile internet. As per 2021 statistics[1], out of 4.66 billion global active internet users; close to 4.32 billion users accessed the internet on mobile devices.

This growth will only witness an upward trend in the coming years, largely catalyzed by 5G, reduced pricing of smartphones, and more. Apart from consuming content on the mobile, many consumers use the hand-held devices for digital banking, bill payments, ordering groceries, etc.

One of the sectors that has witnessed a huge growth is Fintech – integration of finance and technology for easing the use and enhancing the delivery of financial services like P2P lending, loans, insurance, mortgages, etc. by reducing the friction between the users and access to the financial product.

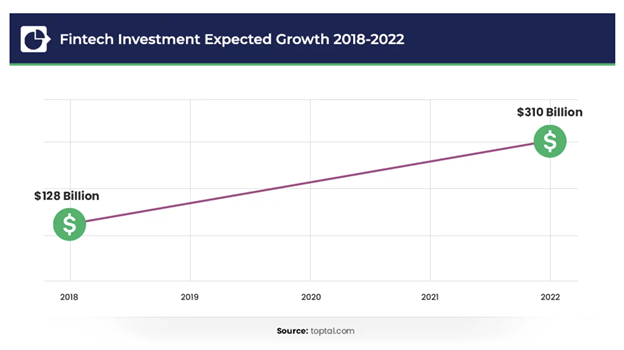

As per reports[2], the global fintech market is expected to reach $309.98 billion by the end of 2022, growing at a 25% CAGR from 2018. The interesting part about the growth story is the upward trend is witnessed in almost all the countries of the world (which also includes the developing nations).

This also means that there is stiff competition in the fintech sector and releasing a scalable, secure, and functionally-rich app (or website) is the only way to woo the customers. To ensure that continuous maintenance and upgrades is not hampering the overall growth, it becomes essential to utilize software testing services of QA outsourcing vendors. Regression testing should be an important part of the fintech testing strategy for ensuring that new features & enhancements aren’t contributing to bugs or other issues.

What Is Regression Testing?

Feature enhancements and bug fixes is a continuous part of any fintech product. Like other products, there is a high possibility that the changes in the source code might impact existing product functionalities. For example – Flow changes in the app can cause issues in other features like comparison engine, checkouts, payments, etc.

This is where regression testing comes into the picture since it helps in verifying whether new enhancements haven’t led to bugs or functionality problems. I have come across cases where addition of geolocation or localization functionalities have also resulted in a breakage of functionalities.

To avoid such issues, QA teams in fintech companies must mandate the practice of regression testing to avoid side-effects on the working source code. In short, regression tests are important for every software product more so for banking & fintech applications as they deal with financial transactions.

Now that I have touched upon the essentials of regression testing (from a fintech point of view), let me deep dive into the details of ‘why’ regression testing is necessary for fintech and banking mobile apps.

Importance of Regression Testing in Fintech

Across the globe, the fintech market exploded after the advent of the COVID-19 pandemic. In developing countries like India, a majority of the smartphone users started using fintech payment apps as the de facto payment method.

With increased adoption, it becomes important for fintech companies to provide customers a glitch-free end-user experience. Here are some of the major reasons why regression testing is critical for the fintech sector:

1. App (and website) upgrades

Fintech apps require continuous functionality upgrades, compliance, and security upgrades for providing top-quality features to the end-users. There is a cut-throat competition between digital players across the globe, due to which they are under constant pressure to ship new features at a breath-neck speed.

The challenge to stay relevant and ahead of the competition might lead to issues in existing functionalities of the app. The launch of new phones could result in serious issues to the app developers since the app experience has to be tailor-made for different device viewports. Such upgrades might also hamper the app’s performance.

A majority of the fintech apps are used by a wide array of customers that use different types of devices (e.g. mobile devices, tablets, desktops, etc.) to access the services offered by the fintech player. Regression testing helps in ensuring that the fintech customers are able to witness a bug-free and uniform experience, irrespective of the device from which the app is used.

Regression testing is done to make sure that the new app functionalities do not cause any side-effects on the existing features of the fintech app.

Also Read – Difference Between Regression Testing and ReTesting

2. Adhere to regulatory compliances

Be it mobile banking or any other form of fintech that deals with monetary transactions, the common point is that the app has to adhere to certain security guidelines. Standardization and data security must be considered as a top priority for such applications.

Fintech rules and regulations[3] also evolve and/or keep changing taking the interests of customers and service providers into consideration.

Also, mobile financial transactions are categorized as a part of e-commerce. Hence, the fintech companies must design, develop, and test the said fintech applications taking the data privacy laws, data protection laws, consumer privacy laws, and individual standards set by the FTC (Federal Trade Commission) or something equivalent for the country where the app will be used.

Partnering with an experienced software testing company into outsourcing will help in ensuring that the overall app is not only user-friendly but also super-secure to be used by the target customers. Since regression testing can be a resource intensive task, onboarding a proven software testing company in the UK, US, India, etc. will be useful in making the most out of the expertise of in-house and outsourced QA resources.

3. Identify bugs at a faster pace

Like all the other forms of testing, regression testing when automated can reap a lot of benefits in the short-term as well as the long-term. Automation in regression testing is known to be much faster than its manual counterpart.

In automated regression testing, the new features/enhancements introduced in the fintech application are tested in a continuous CI/CD pipeline. The concept of shift-left testing can also be applied to regression testing in the BFSI (Banking, Financial Services, and Insurance) sector; as testing and development will happen in a continuous fashion.

Also Read – Key Stages of Penetration Testing

It’s A Wrap

The usage of fintech applications and websites that encompass various offerings (e.g. banking, mortgages, loans, etc.) in a super app will exponentially rise with time. The introduction of new features must be accompanied with rigorous regression testing for ensuring that those features have not impacted the existing functionalities in a negative manner.

Reliability, scalability, security, and functionalities are the guiding pillars of any kind of fintech application. This is where a complete & formidable regression testing strategy will be useful for delivering a fully functional and bug-free product that ups the entire customer experience.

Comments are closed.